The Role of Blockchain Technology in Real Estate Transactions

Unlocking Efficiency: The Role of Blockchain Technology in Real Estate Transactions.

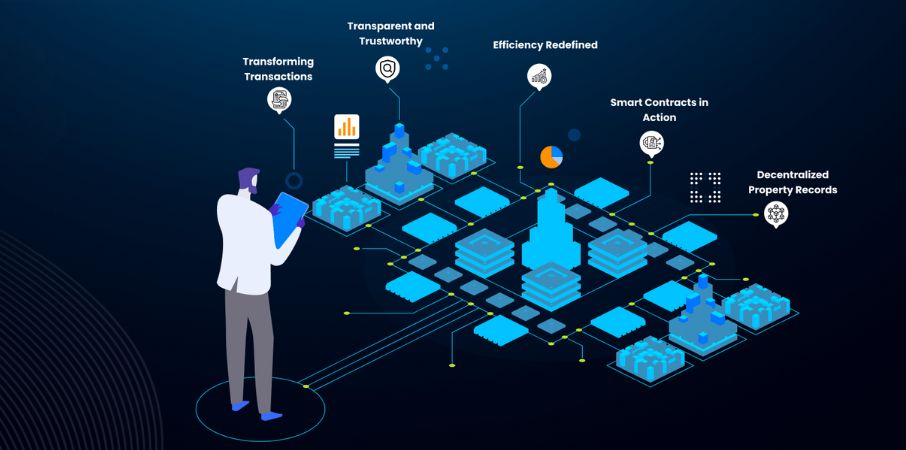

The real estate industry, traditionally known for its paper-heavy processes and long closing times, is on the cusp of a transformative era. Blockchain technology, the secure and distributed ledger system underpinning cryptocurrencies, is emerging as a game-changer, streamlining transactions and enhancing security. This blog explores the potential of blockchain in real estate, examining how it can revolutionize the way we buy, sell, and manage properties.

Beyond the Hype: Understanding Blockchain's Core Benefits

Blockchain offers several key advantages that can significantly impact real estate transactions:

-

Enhanced Transparency: A core tenet of blockchain is transparency. Every transaction is recorded on a secure and immutable ledger, accessible to all authorized participants. This fosters trust and reduces the risk of fraud or errors associated with traditional methods.

-

Improved Efficiency: Blockchain can streamline the entire transaction process. Smart contracts, self-executing agreements stored on the blockchain, automate many manual tasks, eliminating the need for intermediaries and expediting closing times.

-

Increased Security: Blockchain utilizes robust cryptography to create a tamper-proof record of ownership and transaction history. This reduces the risk of document forgery and unauthorized property transfers.

-

Fractional Ownership: Blockchain facilitates the fractional ownership of real estate assets. This allows investors to participate in the market with smaller investments, democratizing access to high-value properties.

Revolutionizing the Process: How Blockchain Impacts Different Aspects of Real Estate

Let's delve deeper into how blockchain can transform various aspects of real estate transactions:

-

Streamlined Due Diligence: Blockchain-based platforms can store and share property ownership records, appraisals, and other critical documents securely. This simplifies due diligence and expedites the entire approval process.

-

Automated Payments: Smart contracts can automate and secure escrow payments and disbursements upon meeting predefined conditions, eliminating delays and potential errors associated with manual transfers.

-

Simplified Property Management: Blockchain can streamline property management by facilitating secure rent collection, recording maintenance history, and automating tenant communications.

Beyond Transactions: The Future of Blockchain in Real Estate

The transformative potential of blockchain in real estate extends far beyond streamlining transactions. Here's a deeper dive into how this technology can reshape the landscape of the industry:

-

Tokenization of Real Estate: This concept involves creating digital tokens on a blockchain that represent ownership interests in a real estate asset. This opens doors to several exciting possibilities:

-

Fractional Ownership: Traditionally, investing in high-value properties requires significant capital. Blockchain-based tokenization allows for these properties to be divided into smaller, tradable tokens. This democratizes real estate investment, enabling a wider range of investors to participate in the market, regardless of their financial resources. Imagine co-owning a luxury vacation property or a commercial building with multiple investors, each holding a portion of the ownership represented by a token.

-

Increased Liquidity: Real estate is traditionally considered an illiquid asset due to the complexities and time involved in selling a property. Tokenized ownership facilitates easier and faster trading on secondary markets specifically designed for these digital tokens. Investors can buy and sell their ownership stake more readily, enhancing the overall liquidity of the real estate market.

-

-

Enhanced Property Management: Blockchain platforms can revolutionize property management by creating a secure and centralized repository of critical information:

-

Comprehensive Property History: A blockchain ledger can store a complete and tamper-proof record of a property's ownership history, renovations, repairs, and maintenance logs. This transparency empowers both investors and tenants with easy access to crucial data, facilitating informed decision-making.

-

Smart Contracts for Rent Payments: Smart contracts, self-executing agreements on the blockchain, can automate rent collection and distribution. This eliminates the need for manual processes and potential delays, streamlining cash flow for property owners and ensuring timely payments for tenants.

-

Energy Efficiency Tracking: Blockchain can be integrated with sensor technology to track a property's energy consumption. This data can be used to identify areas for improvement and implement sustainable practices, not only benefiting the environment but potentially reducing operating costs for both owners and tenants.

-

-

Decentralized Marketplaces: Blockchain technology can pave the way for the creation of peer-to-peer real estate marketplaces that connect buyers and sellers directly, bypassing traditional intermediaries. These platforms offer several advantages:

-

Reduced Costs: Eliminating the need for middlemen can potentially lower transaction fees associated with buying or selling a property.

-

Greater Efficiency: Peer-to-peer marketplaces can streamline the process by automating tasks and providing secure communication channels between buyers and sellers.

-

Globally Accessible Market: Blockchain platforms can transcend geographical boundaries, facilitating cross-border real estate transactions and opening doors for international investors.

-

The future of real estate is undoubtedly shaped by innovation. Blockchain technology holds immense potential to transform the industry, not just by streamlining transactions but by fostering a more transparent, efficient, and accessible property market for all participants.

A Work in Progress: Challenges and Considerations

While the potential of blockchain is undeniable, there are challenges to overcome:

-

Regulation and Legal Framework: The legal framework around blockchain-based real estate transactions is still evolving. Clear regulations are needed to ensure compliance and consumer protection.

-

Technology Adoption: Widespread adoption of blockchain technology within the real estate industry is essential. Realtors, lenders, and other stakeholders need to embrace this technology to fully reap its benefits.

-

Scalability and Integration: Existing blockchain platforms might not be scalable enough to handle the high volume of transactions associated with a global real estate market. Integration with existing industry systems is also crucial.

Embracing the Future: The Path Forward

The future of real estate is undoubtedly intertwined with blockchain technology. While challenges remain, the potential for increased transparency, efficiency, and security is too significant to ignore. By embracing innovation, adapting to a changing landscape, and working collaboratively, stakeholders within the real estate industry can unlock the full potential of blockchain and usher in a new era of streamlined transactions and a more accessible property market.