Renting vs. Buying: Navigating the Housing Crossroads in Today's Market

Renting vs. Buying: Navigating the Housing Crossroads in Today's Market

The decision of whether to rent or buy a home is a pivotal one, impacting your finances and lifestyle for years to come. In today's dynamic market, navigating this crossroads can be particularly challenging. This blog explores the pros and cons of renting versus buying, empowering you to make an informed decision that aligns with your current situation and long-term goals.

The Allure of Ownership: The Advantages of Buying

Homeownership offers a sense of stability, security, and pride that comes with putting down roots in a place you can call your own. Here are some key benefits of buying a home:

-

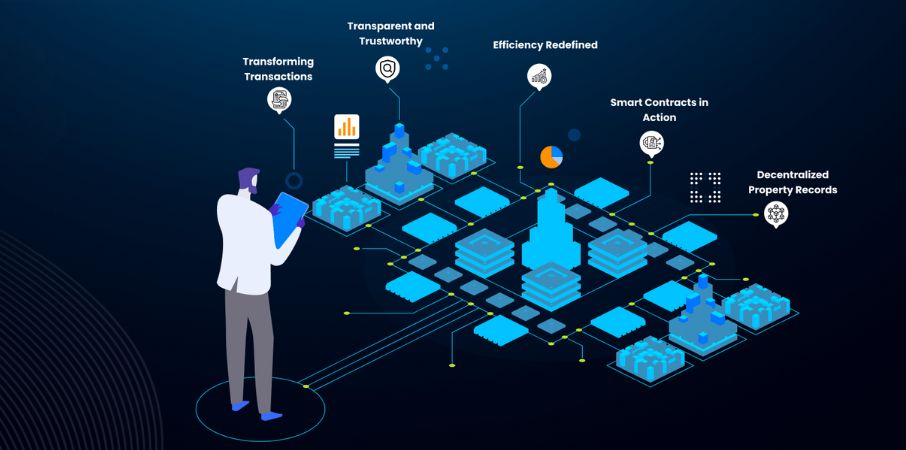

Building Equity: Over time, your mortgage payments contribute to building equity in your property. This ownership stake can provide financial security and a potential source of wealth creation in the long run, especially if property values appreciate.

-

Greater Control and Customization: As a homeowner, you have more control over your living environment. You can renovate, paint, and personalize your space to suit your preferences, creating a home that reflects your unique style.

-

Potential Tax Advantages: Homeowners may be eligible for tax deductions on mortgage interest and property taxes, potentially reducing their overall tax burden.

-

Long-Term Stability: Owning your home can provide a sense of long-term stability, particularly in areas with a stable housing market. You're not susceptible to sudden rent increases or lease expirations that might force you to relocate.

The Flexibility Factor: The Benefits of Renting

Renting offers a level of flexibility and freedom that can be particularly appealing in certain life stages. Here are some of the advantages of renting:

-

Lower Upfront Costs: Unlike buying, renting requires a significantly lower upfront investment. There's no need for a down payment, closing costs, or the burden of property taxes and homeowner's insurance. This frees up capital for other financial goals or allows you to live in a more desirable location that might be out of reach when considering buying.

-

Maintenance-Free Living: Landlords are typically responsible for major repairs and maintenance issues. This frees you from the time and financial burden of dealing with plumbing problems, leaky roofs, or appliance breakdowns.

-

Greater Mobility: Renting allows for greater flexibility and mobility. If your career requires frequent relocations or you're unsure of your long-term plans, renting allows you to move easily without the complexities of selling a property.

-

Predictable Monthly Costs: Rental payments typically offer predictable monthly costs, making budgeting easier. You're not responsible for unexpected property taxes or maintenance expenses that can disrupt your financial planning.

Weighing the Scales: Factors to Consider When Making Your Decision

The decision to rent or buy is a personal one with no one-size-fits-all answer. Here are some crucial factors to weigh before making a choice:

-

Financial Situation: Consider your current financial standing, including your income, savings, and debt levels. Can you comfortably afford the upfront costs and ongoing expenses associated with buying a home?

-

Long-Term Plans: How long do you plan to stay in one place? If you foresee frequent moves in the near future, renting might be the more flexible option. Buying might be a better choice if you plan to settle down in one location for an extended period.

-

Market Conditions: Consider the current state of the housing market in your desired location. Are property values stable or appreciating? Is the rental market competitive with a limited supply of available units?

-

Lifestyle Preferences: Do you prioritize stability and the ability to customize your living space? Or do you value flexibility and the freedom to move easily? Align your decision with your lifestyle preferences.

Taking Action

-

Research the Market: Gather information on current market trends, average rental rates, and property values in your desired location.

-

Assess Your Finances: Create a realistic budget that factors in potential mortgage payments, property taxes, and maintenance costs associated with buying a home.

-

Seek Professional Guidance: Consult with a financial advisor or realtor who can provide personalized advice based on your specific circumstances and financial goals.

-

Consider All Costs: Don't just focus on the monthly rent or mortgage payment. Factor in additional expenses like utilities, maintenance, property taxes, and homeowner's insurance when comparing renting vs. buying.

Beyond the Financial: Considering Hidden Costs and Long-Term Implications

-

While finances are a crucial factor, the decision to rent or buy should also consider hidden costs and long-term implications. Owning a home can foster a sense of community and encourage you to invest in your surroundings. You might be more likely to participate in neighbourhood events or take pride in maintaining your property's curb appeal. On the other hand, renting can free up time and resources to pursue hobbies, travel, or career advancement.

-

The emotional aspect also plays a role. Homeownership can offer a sense of security and stability, particularly for families. However, the responsibility of maintenance and potential unexpected repairs can be stressful. Ultimately, the best choice hinges on what brings you the most peace of mind and aligns best with your current life stage and priorities.

-

Remember, there's no right or wrong answer. The decision to rent or buy is a dynamic one. Your circumstances might change over time, and what's right for you today might not be the best fit five or ten years down the line. Revisit your decision periodically, reassess your financial situation and lifestyle goals, and be prepared to adapt your approach as needed. The key lies in making informed choices that allow you to live comfortably and create a space that reflects your unique journey.